The US dollar has long been the anchor of the global financial system. But with shifting economic dynamics, policy uncertainty, and changing investor behaviour, many are asking: has the greenback’s dominance reached its peak?

In a recent webinar, Steven Barrow, Standard Bank’s head of international research, explored the dollar’s outlook and its implications for investors seeking diversification.

Here are some of the key takeaways:

Dollar cycles

Since floating exchange rates took hold in the 1970s, the dollar has mostly moved in long-term cycles of five to 10 years, with the most recent upcycle starting in 2011.

But questions are starting to arise about whether we’ve reached the dollar’s peak, and if we might see the start of a downward trend for the greenback.

The four factors that might contribute to the dollar’s weakness

- Declining dollar dominance.

- Portfolio reallocation away from the US.

- Dollar policy.

- Poor trading performance.

The dollar’s dominance

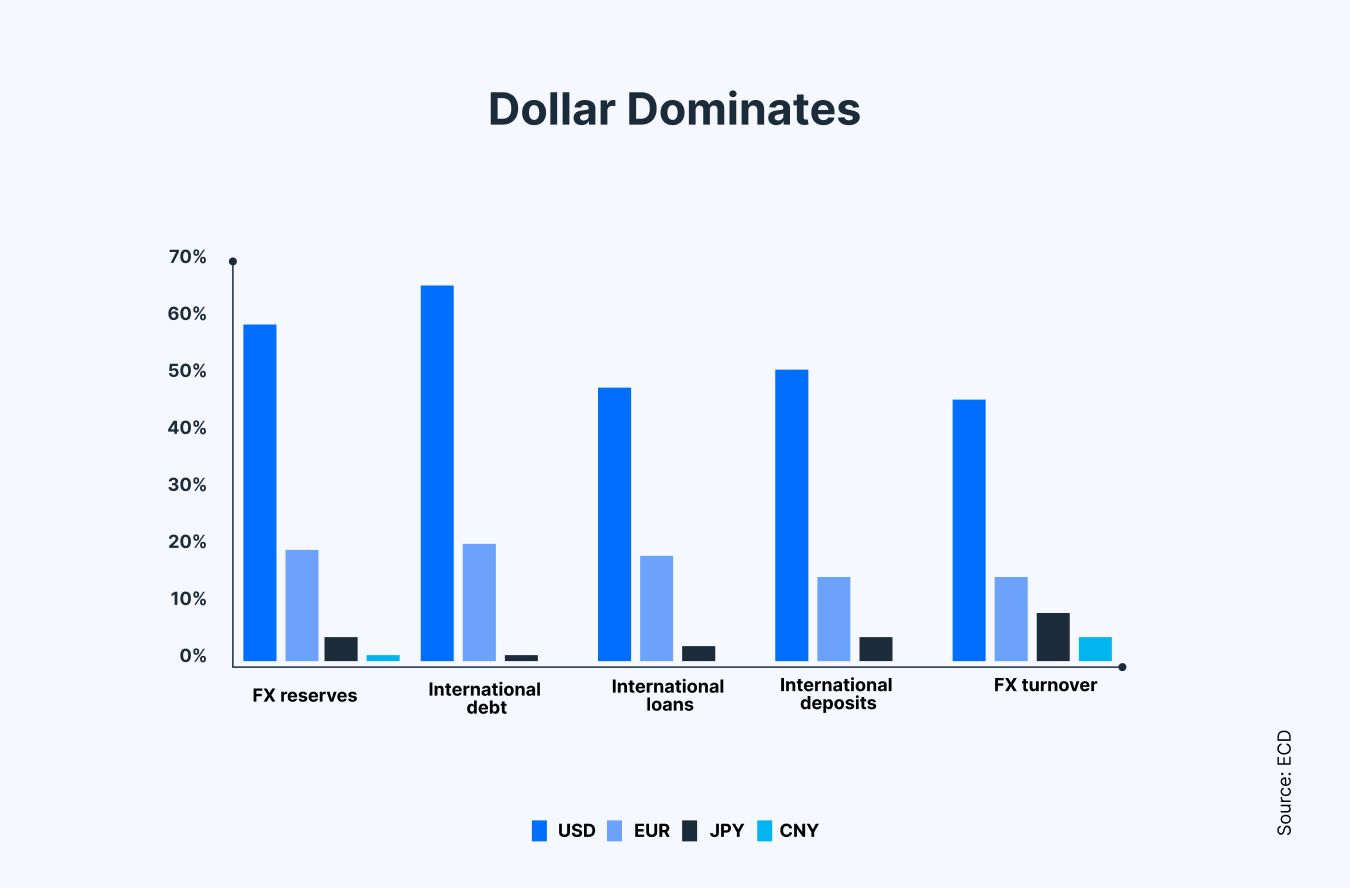

The dollar is the foremost international currency. It dominates FX reserves, international debt, loans, deposits and FX turnover, with the euro being a distant second.

What will happen if the dollar loses its dominance? Lessons from the sterling

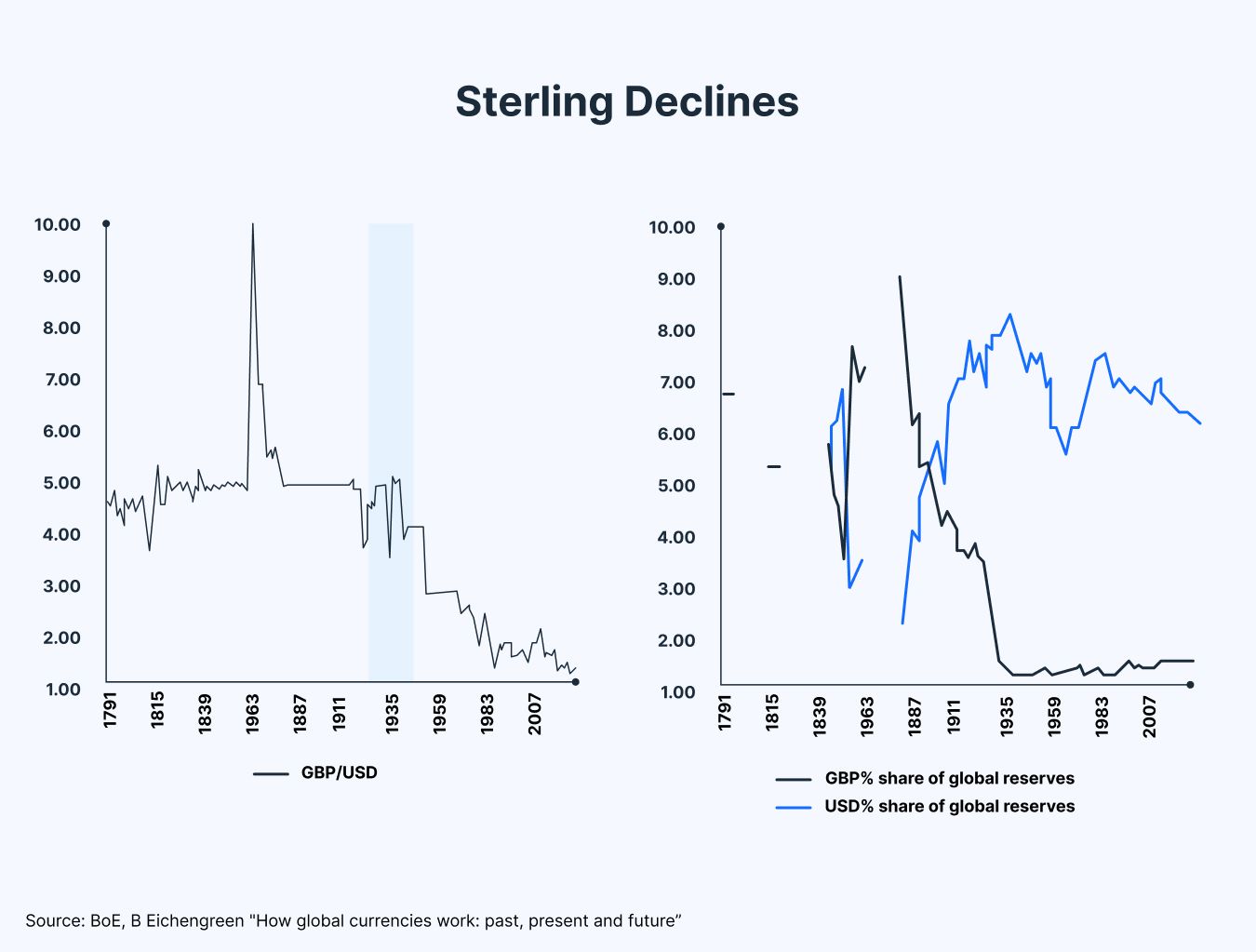

Data dating back to the 1800s shows that the pound was the dominant currency, with the dollar taking pole position in the 1930s and 1940s. The sterling has since fallen.

Sterling’s share of global reserves also collapsed from nearly 90% in the 1940s/50s to almost nothing by the 1970s, with the dollar moving in the opposite direction from close to 10% up to as much as 80%. Today, it is about 60%. The greenback has rallied quite strongly against the pound during that period.

So, evidence suggests that if the dollar loses dominance, its value will decline.

Portfolio reallocation

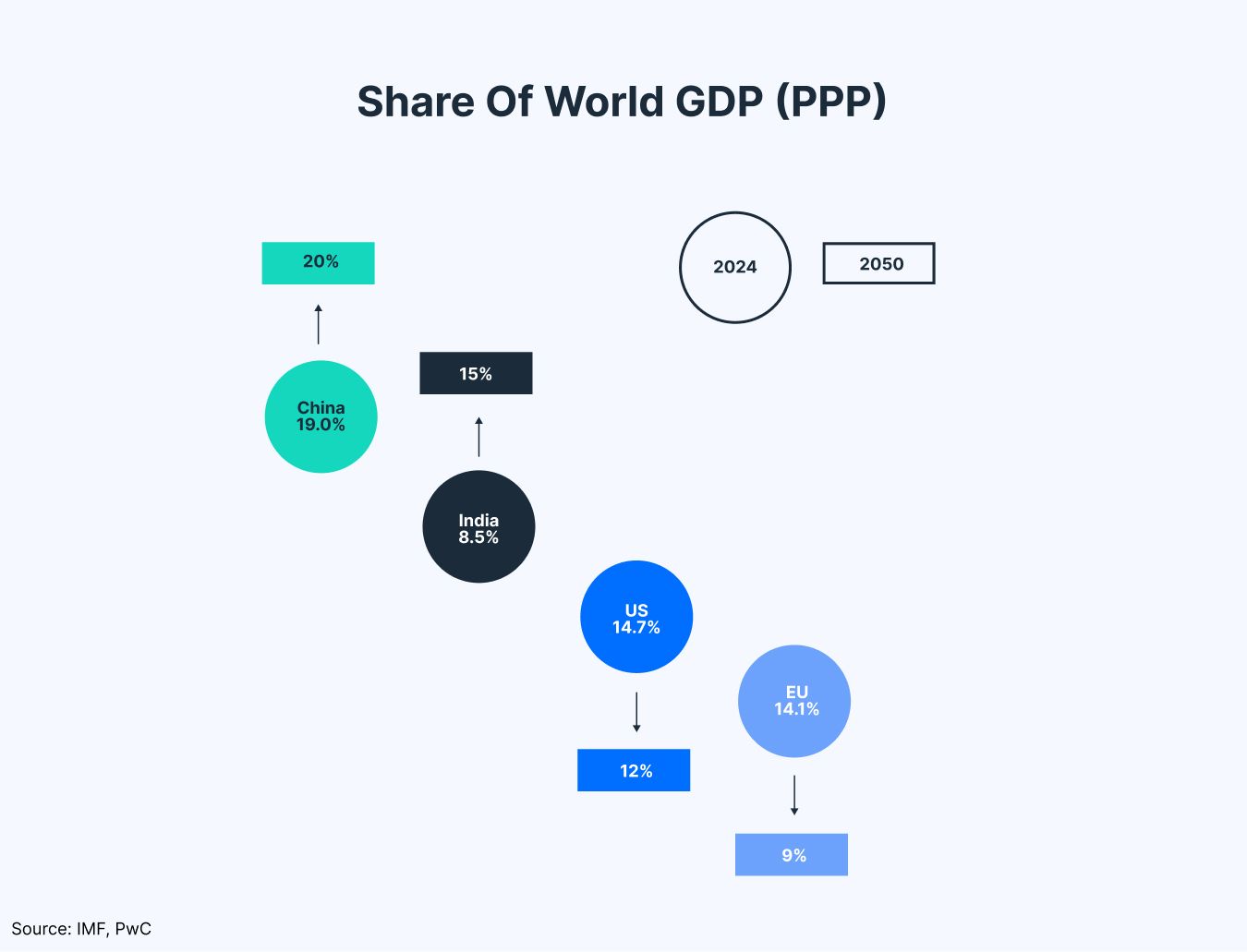

While the US economy has been growing, its share of global GDP has shrunk to around 15% and is projected to fall further to 12% by 2050.

However, the share of the US stock market in global stocks has increased quite dramatically; about 50% to 60% of global stock market capitalisation is in the US.

Many investors around the world have been pushing money into the US, particularly during tech booms. This has created a concentration risk, and investors may need to reallocate funds to other markets.

Dollar policy: weighing strength and weakness

The US administration faces a dilemma. While it would like the dollar to retain its dominance due to the economic and perhaps political leverage it gives the country, a stronger dollar makes US exports more expensive, which works against its plans to turn its trade deficit into a balance or a surplus.

Politics at play

Political cycles also appear to play a role in dollar performance. Historically, the dollar has tended to strengthen under Democratic presidents and weaken under Republicans – possibly reflecting differences in fiscal policy and budget management.

Pressure on the Fed

President Donald Trump has repeatedly urged the Federal Reserve to cut rates not because of economic weakness but to ease the burden of financing America’s $26 trillion external debt.

Is the dollar still a safe haven?

Traditionally, the dollar has been the ultimate safe-haven asset in times of turmoil.

Yet, despite heightened geopolitical and economic uncertainty this year, the introduction of US tariffs against trading partners – which would normally strengthen a currency – and the Federal Reserve holding interest rates steady, giving the US a roughly 2% advantage over other G10 currencies, the greenback has slipped.

This suggests that investors may no longer view it as the default safety play it once was.

Is the dollar likely to enter a longer-term downward cycle?

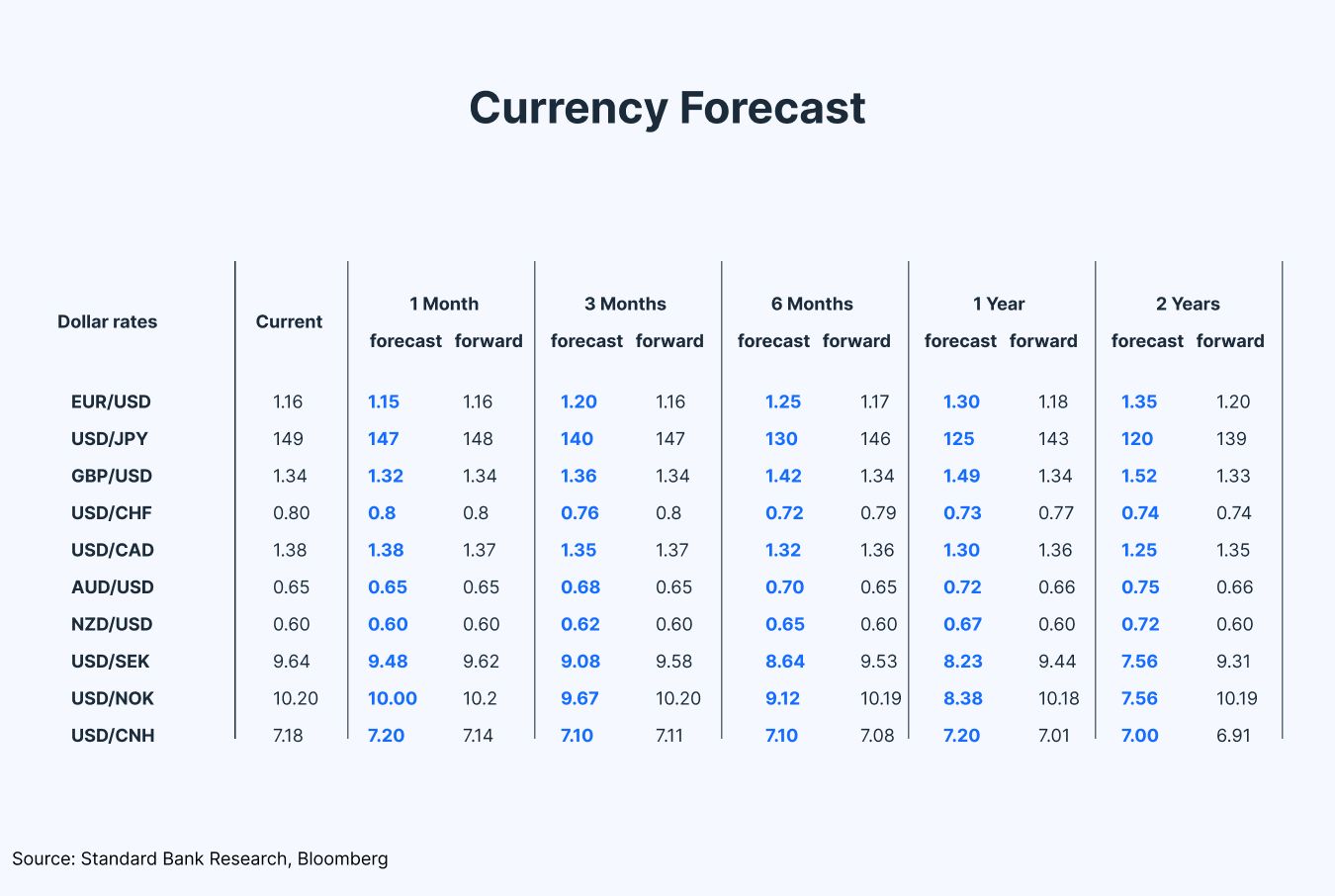

Broadly speaking, it is. Here’s a look at the G10 forecasts:

The best currency may not be a currency at all

Barrow highlighted that, in real terms, all major currencies have lost significant value against gold over the past decade due to central banks expanding their money supply through ultra-loose monetary policy.

He argued that the best store of value may not be a currency at all but an asset with restricted supply that holds its value better.

He referenced investor Ray Dalio’s suggestion that portfolios include 15% exposure to gold, crypto, or a combination of both.

Interestingly, the US is also pushing to dominate stablecoin issuance, which could help sustain dollar demand in the digital age. If widely adopted, dollar-backed stablecoins could counterbalance the erosion of the dollar’s global role.

The Swiss franc: A quiet winner

When asked which currency he would personally hold today, Barrow’s choice was clear: the Swiss franc. Despite near-zero interest rates, the franc has steadily appreciated over time.

Final thoughts

The dollar remains the world’s most powerful currency, but its grip is loosening. For investors, the key message is not to abandon the dollar altogether, but to diversify, whether through exposure to other currencies, emerging markets, or alternative assets.

The views and opinions shared are for informational purposes only. They are not intended to serve as investment advice and do not represent the views or opinions of Standard Bank. This information should be used as a starting point for generating investment ideas, and should not be relied upon as the basis for making investment decisions. The Standard Bank of South Africa Limited will not be responsible for the results of any investment decisions made based on the views provided.