From GDP to IPO, investing is a field full of acronyms. That is useful if you live and breathe investments. However, most people just want to understand the basics and feel confident that their finances are in good shape.

One of the most powerful investment tools available today is, you guessed it, best known by its acronym: the ETF. Exchange-traded funds have been revolutionary for everyone from hedge fund hotshots to DIY investors. For the latter, the utility of ETFs lies mainly in how they pack tremendous usefulness into a really simple bundle.

Let’s explain how.

What is an ETF?

An ETF, or exchange-traded fund, is often described as an investment “wrapper”. That is what it does: it wraps up one or more assets into a single, uncomplicated investment package.

ETFs are defined and governed by legislation. Fund managers create them and list them on stock exchanges. In South Africa, this means the Johannesburg Stock Exchange (JSE).

The fund manager has great freedom to decide what assets go into the ETF. It could be a selection of shares, bonds, commodities, or even cash.

For the more adventurous, the first explorations into ETFs holding cryptocurrencies have also begun.

The result is that we can buy an ETF on the JSE (see what we mean about acronyms!) as a means of buying anything from tech stocks on Wall Street to a blend of local stocks and bonds or even physical platinum. This ETF then trades on the JSE. Just like any share, we can buy and sell with the click of a button or watch the price change in real time during the trading day.

The rise of the ETF

ETFs date back to the early 1990s. Canada was a trailblazer, launching the first true ETF, the Toronto 35 Index Participation Units (TIPs), on the Toronto Stock Exchange in 1990. This allowed investors to buy a single product that held a basket of the 35 largest Canadian stocks. And we haven’t looked back.

Soon, ETFs began to be built to target specific industries and regions. Investors could buy an ETF containing a portfolio of tech stocks, for example, or a resident of one country could buy an ETF covering industrial shares in another country.

ETFs also expanded beyond shares. Including government bonds in an ETF is just as simple as including shares. You can blend them, too.

These days, you can even buy commodities with an ETF. In this case, you have exposure to the actual physical asset. For example, holding a gold ETF means you’re allocated a proportionate share of physical gold in a secure vault.

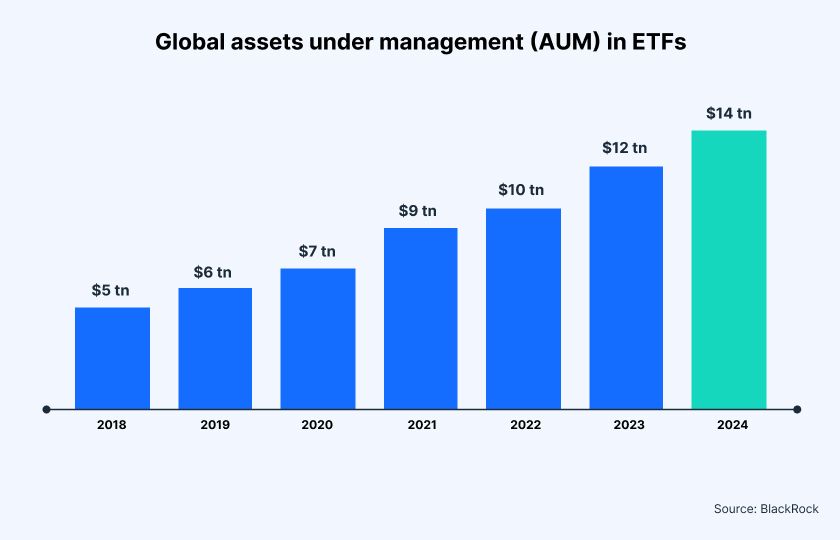

Source: BlackRock

All-rounders of the investing world

When there are so many acronyms to choose from, why is the ETF growing so impressively? In short, ETFs are the ultimate all-rounders.

First, ETFs are really simple. Yes, there is a lot of complexity involved on the back end. These products must be designed, registered, launched, and managed in a strictly regulated environment, but ETFs are straightforward for the end user.

Whether you’re a DIY investor, financial advisor or hedge fund boss, you can quickly establish what assets are in an ETF.

Second, ETFs are highly transparent. From the start, you can see exactly which assets are included in your ETF. You can also track performance in real time as the product trades on the stock exchange.

Third, ETFs make diversification easy. A single ETF can hold a variety of asset types from multiple countries. This makes them ideal tools for building a balanced portfolio that optimises your risk-to-return ratio.

Finally, sheer cost-effectiveness is a significant benefit of ETFs. A small team of expert fund managers can build and maintain a bundle of ETFs of practically unlimited size. This means ETFs are highly efficient. Each individual pays only a small fraction of a percentage point in fees.

Active versus passive ETFs

ETFs tend to be categorised as either active or passive. The difference is important. Active ETFs are designed with the intention to beat a specific benchmark. For example, a fund manager may have designed a strategy to profit from a major trend in technology.

Passive funds, on the other hand, aim purely to replicate an index. Hence their alternative names, “index funds” or “index-tracking funds”. The funds are often named after well-known indices, such as the S&P 500 or the JSE Top 40.

Passive ETFs contain the same assets as the underlying index in the same proportions. Of course, as prices change over time, the proportions in the ETF will vary. That is why an ETF is rebalanced at set intervals. This is when fund managers buy and sell assets to ensure weightings in the product continue to mimic the underlying index.

None of this means that active is better than passive, or vice versa. Or that one will ensure higher returns than the other.

Rather, it is a matter of choice. Your goals, obligations, risk appetite, and other distinguishing characteristics make you a unique investor. Your choice of products should reflect that.

Where to next for ETFs?

A study by professional services firm PwC captures the mood around ETFs. They reported that the total value of assets held in ETFs worldwide grew by 27% in 2024, reaching US$14.6 trillion by the end of the year.

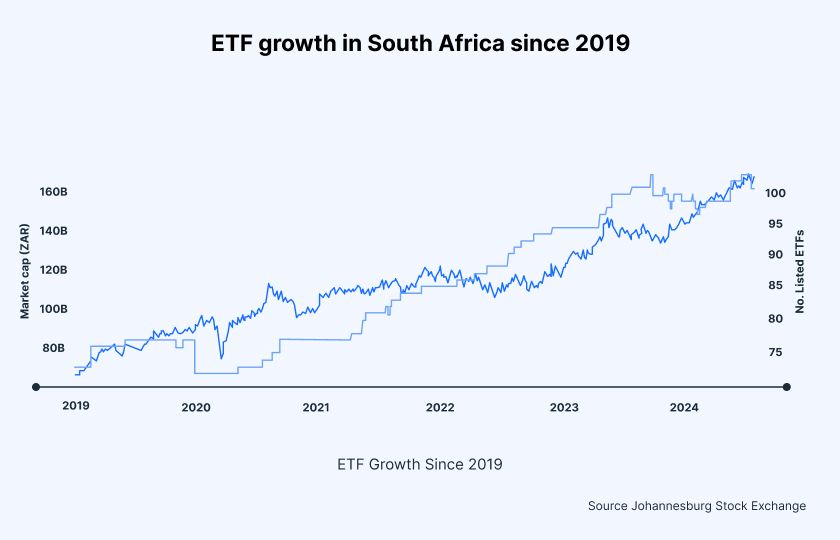

South Africa is part of the global trend of booming ETF investing. ETFs have exhibited strong growth in recent years by both market capitalisation and the number of listed products.

ETF growth in South Africa since 2019

Source: JSE

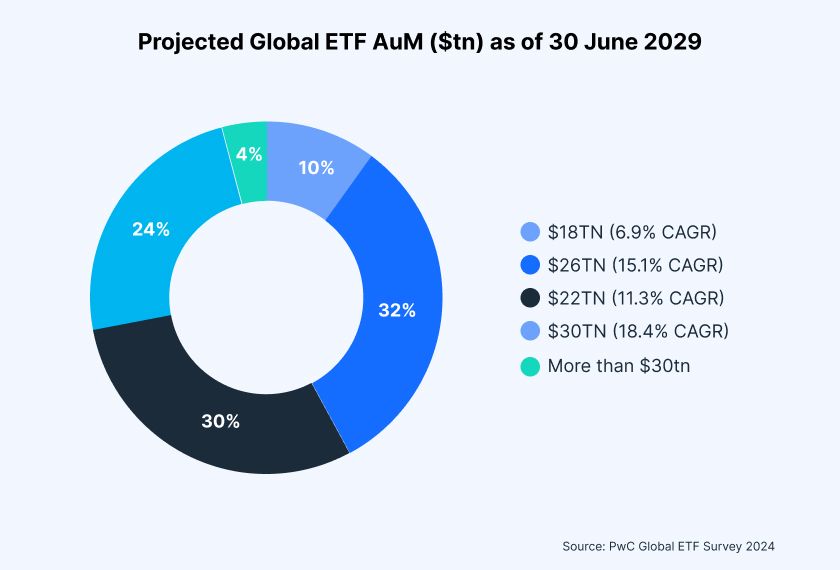

PwC’s survey data suggests that there is more room for growth in the future, too: “Nearly one in three of our survey respondents expect global ETF AuM (assets under management) to more than double to reach US$30 trillion over the next five years, while 60% expect global ETF AuM to reach at least US$26 trillion by June 2029.”

Source: PwC Global ETF Survey 2024

There’s an app for that!

Shyft puts the world of ETFs at your fingertips. Your Shyft account gives you access to hundreds of ETFs worldwide (including those listed on the Johannesburg Stock Exchange), across every industry. Whether you want Magnificent Seven tech shares, a golden hedge against the rand, or to grow your exposure to emerging Asian nations, we have an ETF for you.

If you’d like to invest in ETFs on Shyft, log in, go to Shares, select the currency of your choice in the top right-hand corner, select Browse Shares, and choose the ETFs tab. Click on a specific ETF to view its description, and go to View Instrument Details to find the “Buy” button.

The views and opinions shared are for informational purposes only. They are not intended to serve as investment advice and do not represent the views or opinions of Standard Bank. This information should be used as a starting point for generating investment ideas, and should not be relied upon as the basis for making investment decisions. The Standard Bank of South Africa Limited will not be responsible for the results of any investment decisions made based on the views provided.

Shyft operates under the license of The Standard Bank of South Africa Limited, an authorised Financial Services Provider (FSP number 11287).