Exchange-traded funds (ETFs) have been part of the South African investment landscape for nearly three decades, with the first ETF launched in November 2000.

Since then, the ETF sector in the country has continued to evolve, with commodity ETFs launching in 2004, bond ETFs arriving in 2010, sustainability-focused ETFs following in 2012, and actively managed ETFs (AMETFs) debuting in 2023.

Today, South Africa’s exchange-traded products (ETP) ecosystem, which includes ETFs, AMETFs, exchange-traded notes and actively managed certificates, is valued at R284.6 billion, with ETFs accounting for 78.7% of the market capitalisation of the total SA ETP industry.

According to ETFSA’s State of the South African Exchange Traded Product Industry report, as at 30 September 2025, there were 284 ETPs listed on the JSE.

Different strokes for different investors

ETFs have traditionally been passive. However, investment innovation and regulatory support have led to the development of AMETFs.

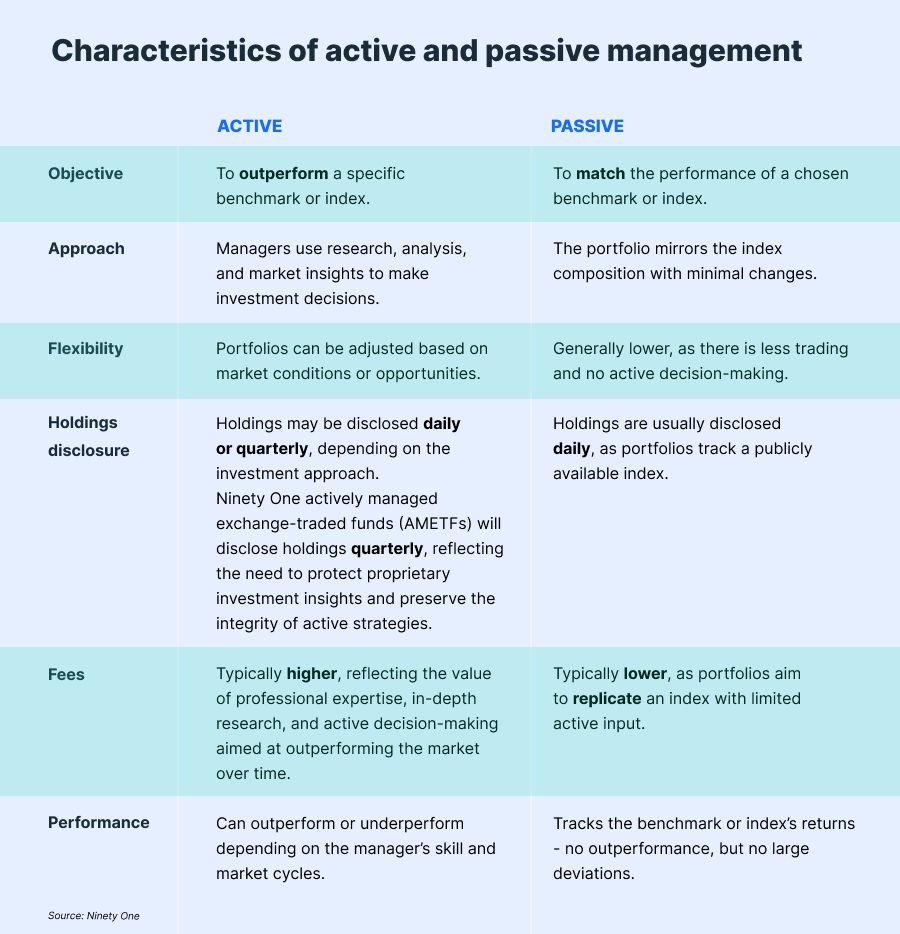

So, what’s the difference between the two?

AMETFs have a fund manager or team making investment decisions to outperform a benchmark or index. Managers actively select securities, sectors, or asset classes they believe will deliver superior returns over time.

This gives investors access to the same level of portfolio management typically found in traditional unit trusts.

Passive ETFs, on the other hand, seek to replicate the performance of a particular market index, such as the FTSE/JSE Top 40 or S&P 500, by holding the same securities in the same proportions.

Here’s a detailed breakdown of the characteristics of each strategy:

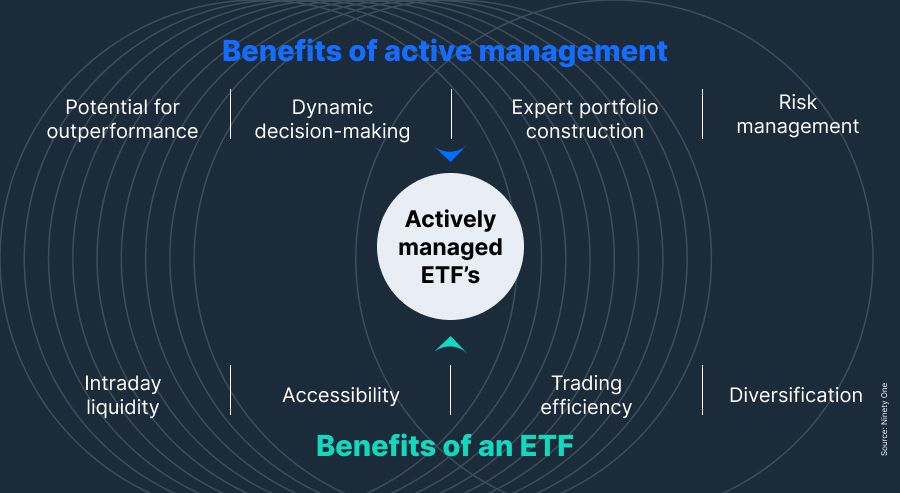

What are the benefits of AMETFs?

AMETFs combine the judgment and experience of skilled fund managers with the added benefits of real-time pricing, intraday liquidity, and continuous trading during market hours.

Investors can also tap into a more diverse range of underlying strategies through these products, as fund managers can tailor the ETFs towards specific themes. Multi-asset AMETFs, for instance, can focus on various sectors, including tech and income, adding significant diversity to the ETF listing space.

But why not both?

Nothing is stopping you from using both strategies. In fact, doing so can be quite beneficial, as it further diversifies your portfolio.

Passive investments provide a low-cost foundation and broad market exposure, while active management enables skilled fund managers to identify opportunities for outperformance and manage risk through different market cycles.

By blending these approaches, investors can achieve cost efficiency, maintain consistent market participation, and potentially enhance returns through targeted active strategies.

This combination also diversifies investment style, reducing reliance on any single strategy.

Want to learn more about ETF investing? Read our starter’s guide here.

If you’re ready to start investing in ETFs, Shyft offers a wide variety that provides investors with exposure to different sectors and regions.

These ETFs include the recently listed Ninety One income-focused AMETFs: the Ninety One Diversified Income Prescient Feeder AMETF (91DINC) and the Ninety One Global Diversified Income Prescient Feeder AMETF (91GINC). These are now available to you on Shyft.

Remember to always consult a financial advisor before making any investment decisions.

*Information provided by Ninety One.

The views and opinions shared are for informational purposes only. They are not intended to serve as investment advice and do not represent the views or opinions of Standard Bank. This information should be used as a starting point for generating investment ideas, and should not be relied upon as the basis for making investment decisions. The Standard Bank of South Africa Limited will not be responsible for the results of any investment decisions made based on the views provided.