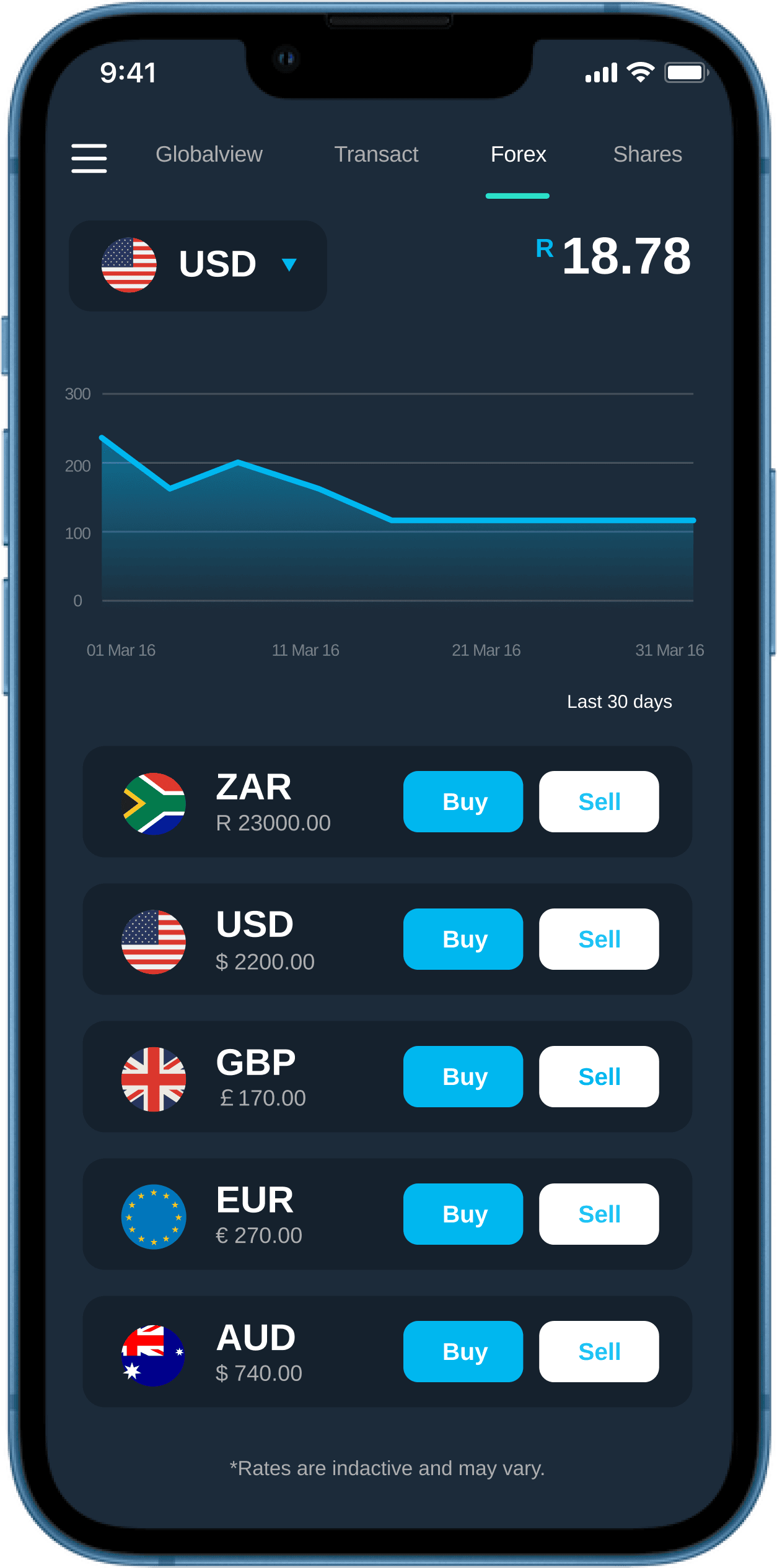

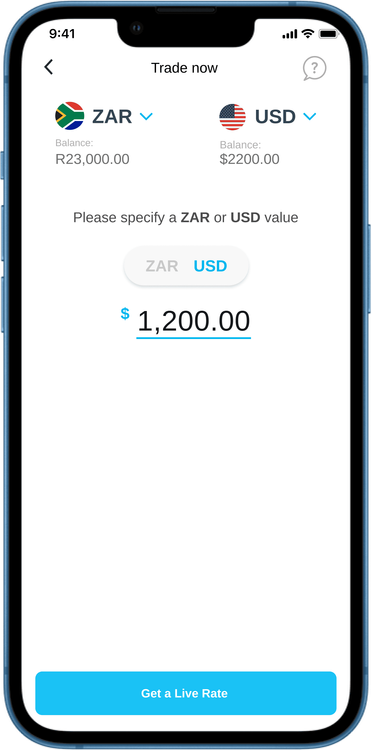

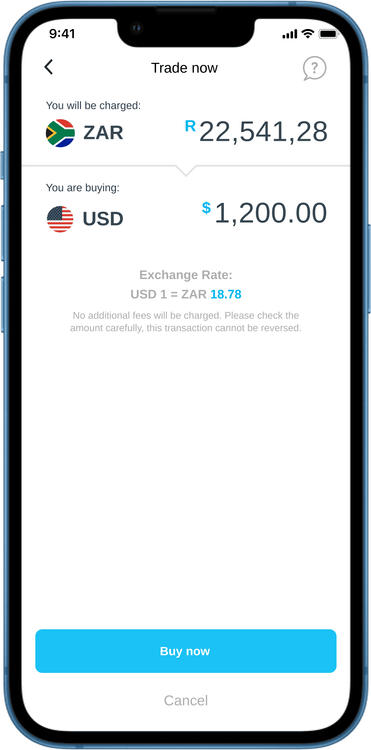

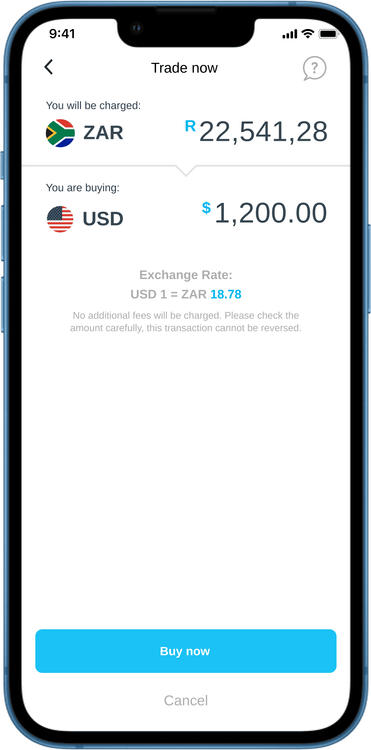

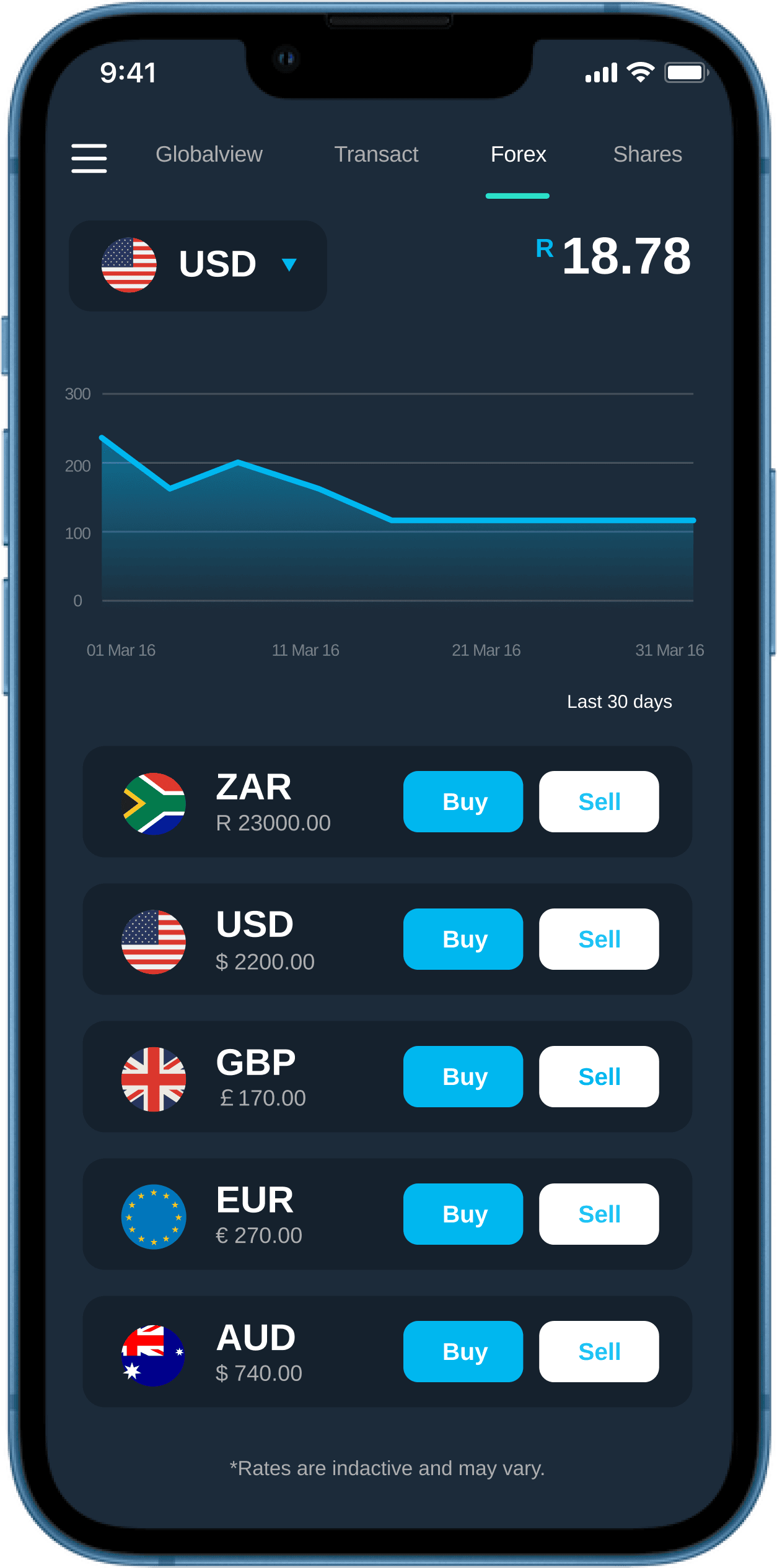

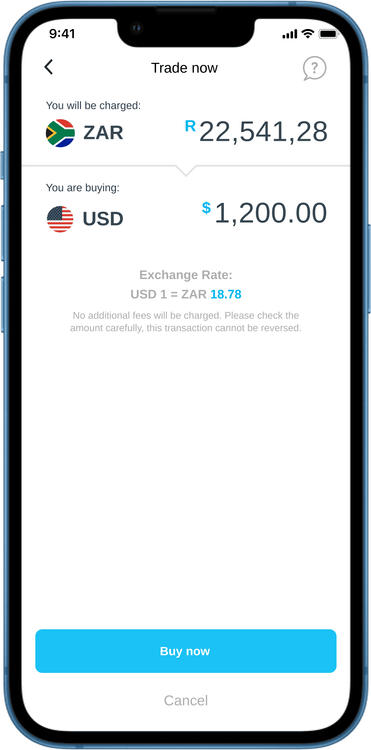

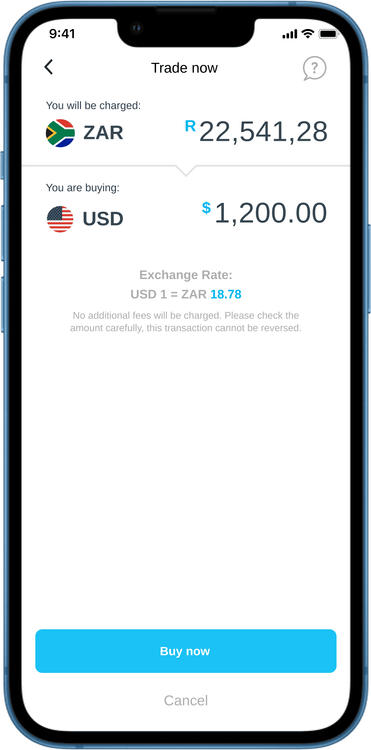

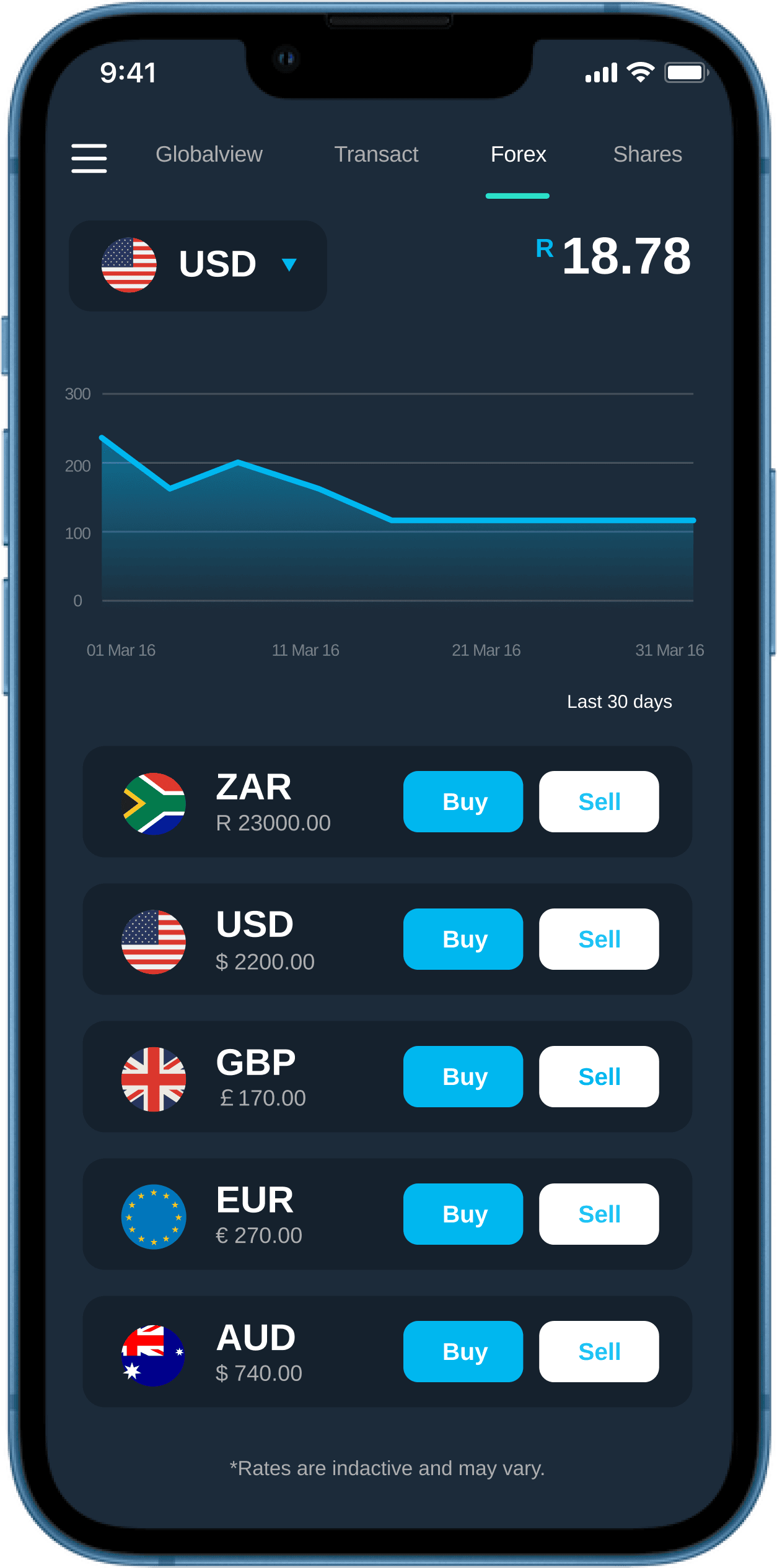

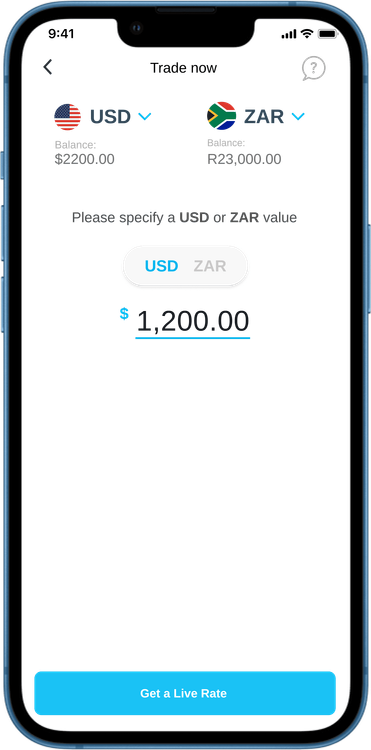

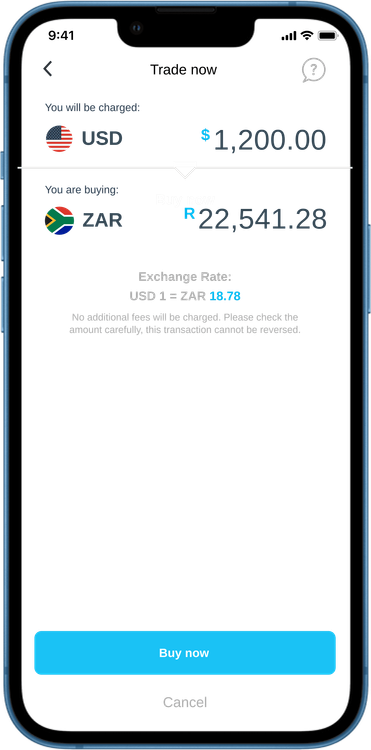

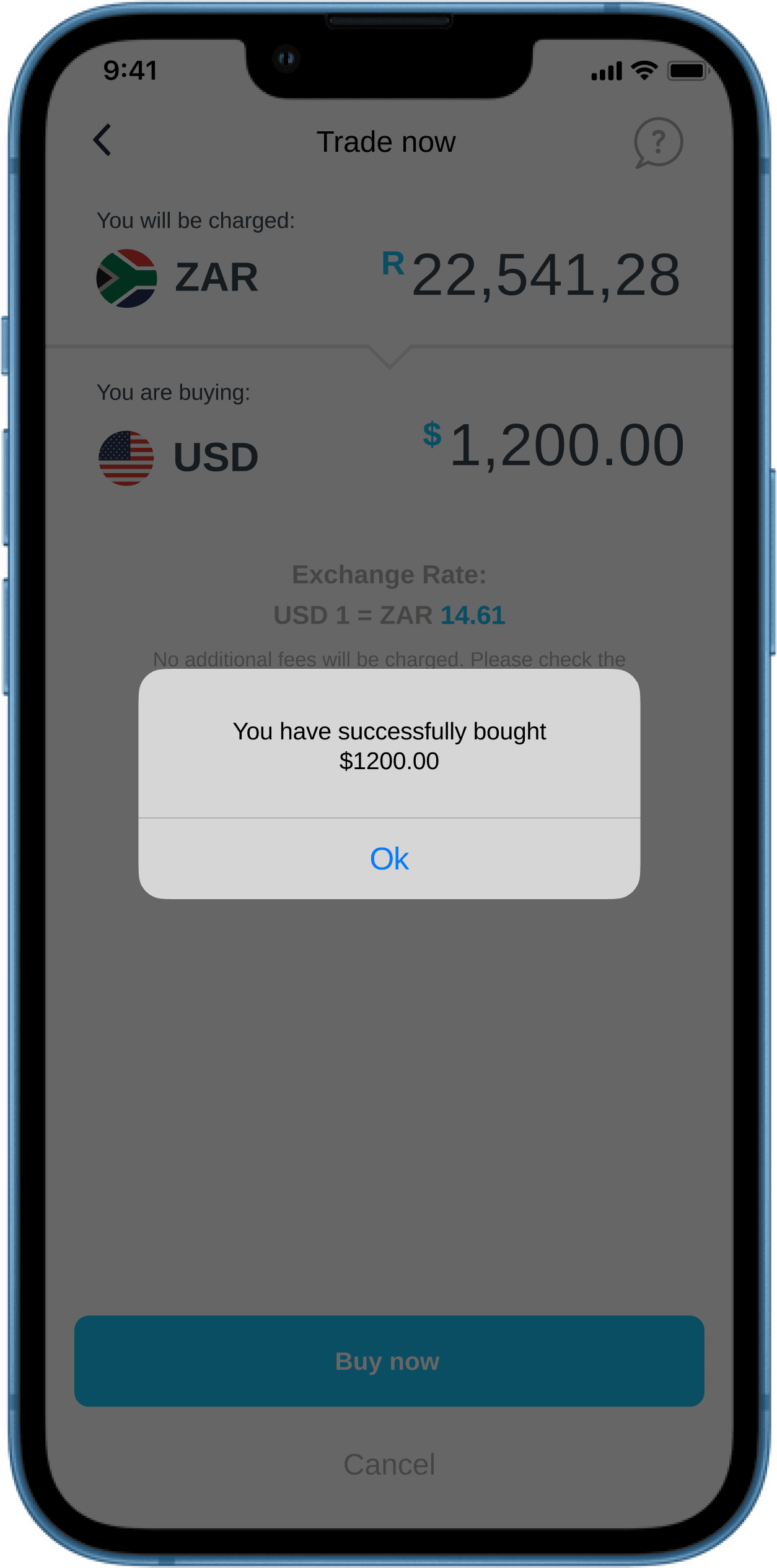

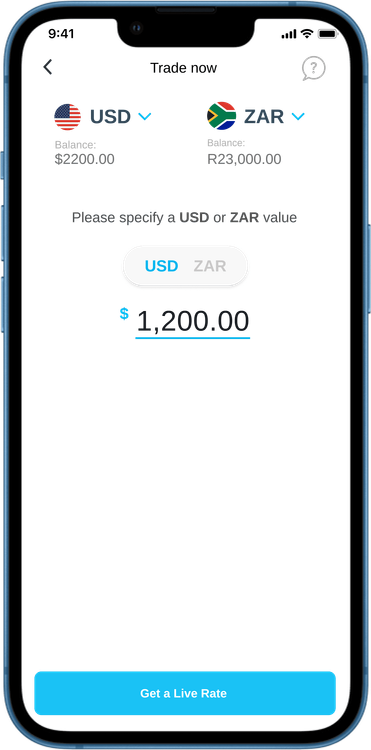

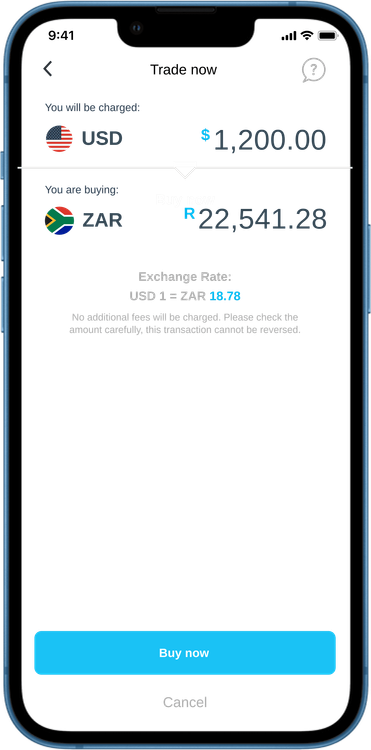

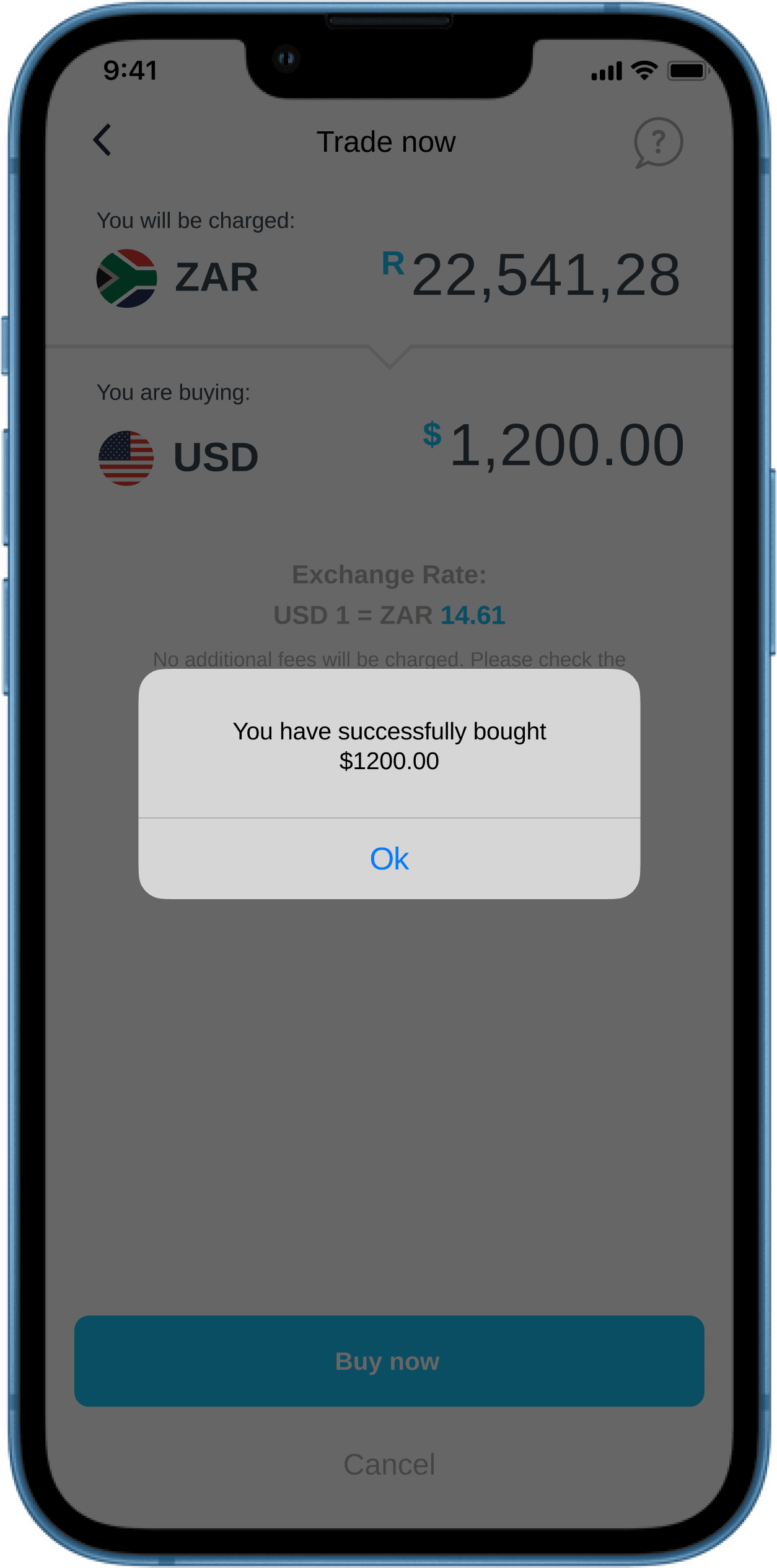

Standard Bank/Stanbic charges a fee on all foreign exchange transactions. It is included as part of the live rate that you are quoted when purchasing foreign currency. The price you see is the price you pay, and there are no additional costs for purchasing foreign exchange through Shyft.

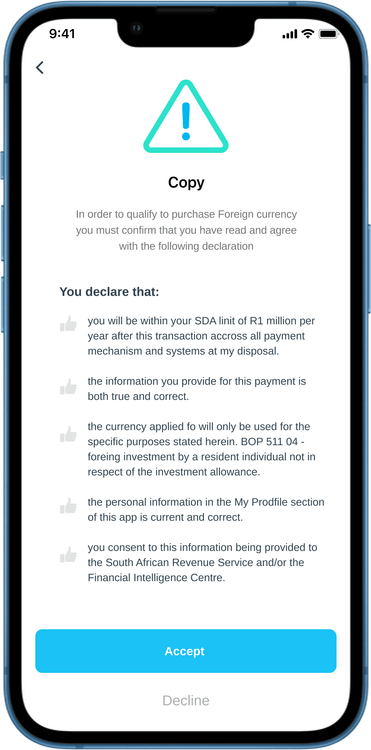

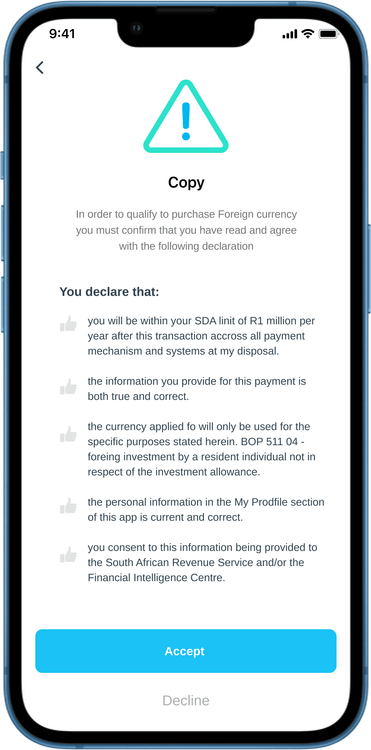

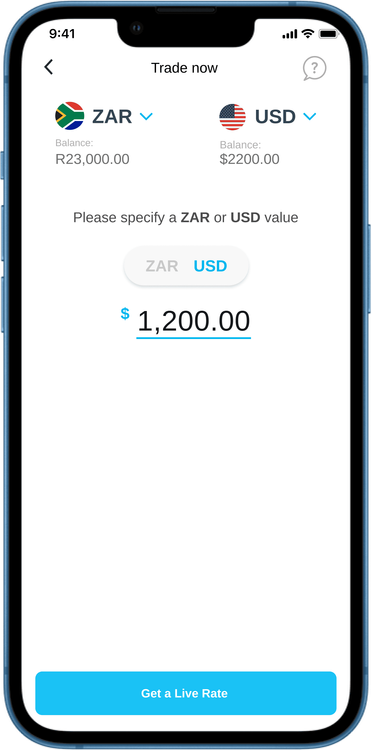

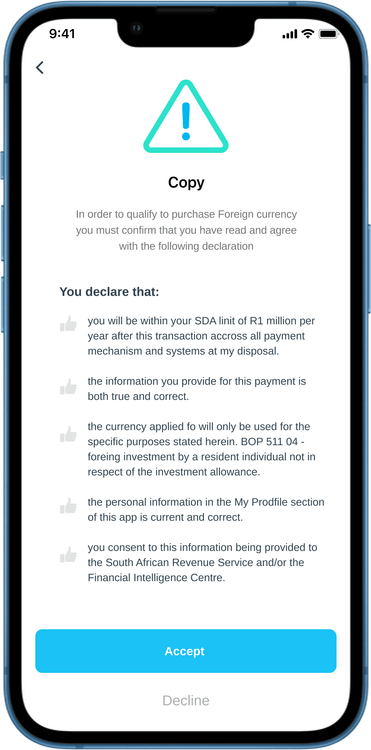

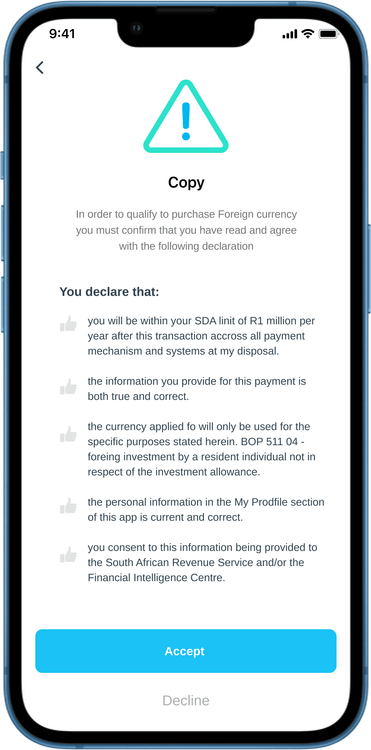

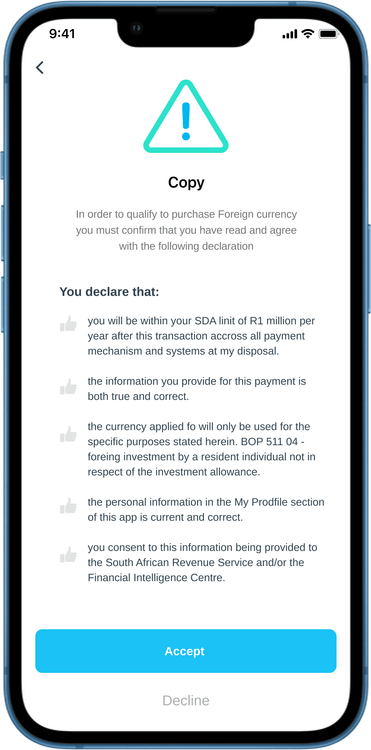

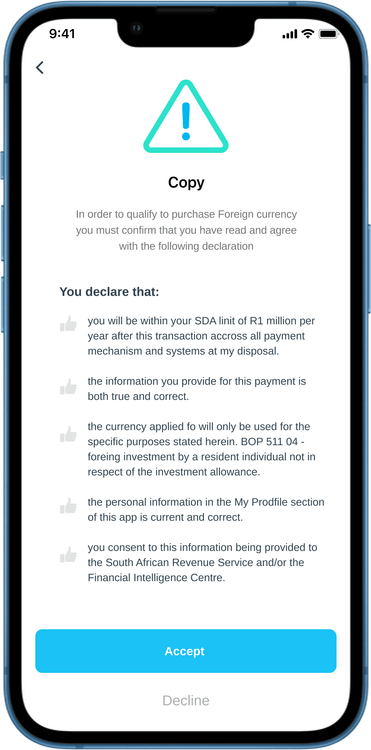

As a South African, you're allowed up to R1 million for 'offshore activities' each calendar year without needing tax clearance.

This falls under your annual Single Discretionary Allowance (SDA), set by the South African Reserve Bank, available to all South African residents over 18 with a valid South African identity document. Your allowance applies to all of your 'offshore activities,' not just those facilitated through Shyft.

NB: On Shyft, your annual allowance is only affected when buying or selling foreign currency, not when sending funds abroad via an international payment to an offshore bank account.

Once you reach the limit of your Single Discretionary Allowance within Shyft, you will be prohibited from purchasing any further forex for the rest of the calendar year, until your allowance resets on January 1st.

You will receive a notification on Shyft when you reach your limit.

For foreign nationals, if your work permit becomes invalid or expires, or if you reach your limit in terms of the amount of funds you can externalize, you will not be able to purchase any further foreign currency through Shyft. However, you can still use the foreign currency you have already purchased to make international payments and spend on your Shyft cards.

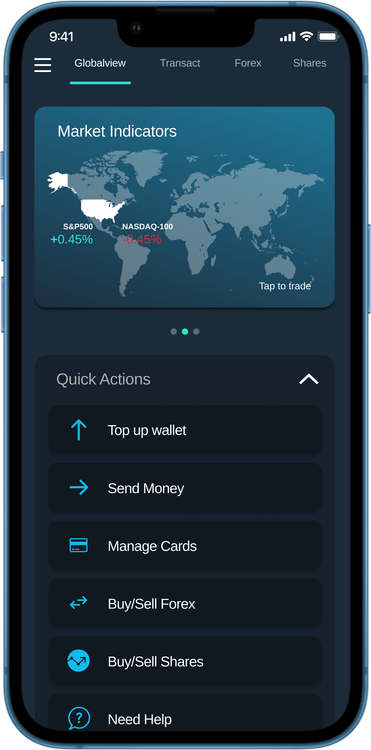

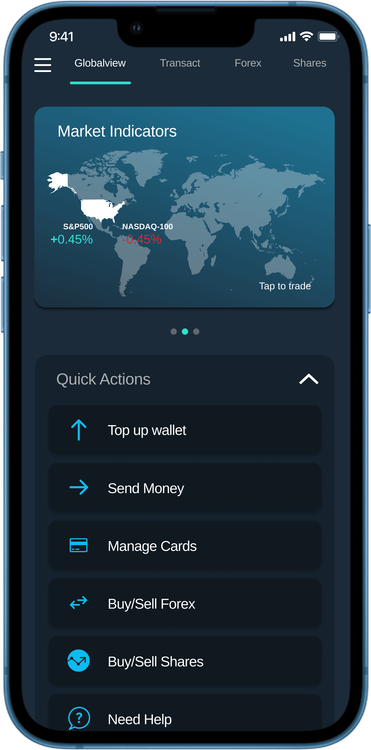

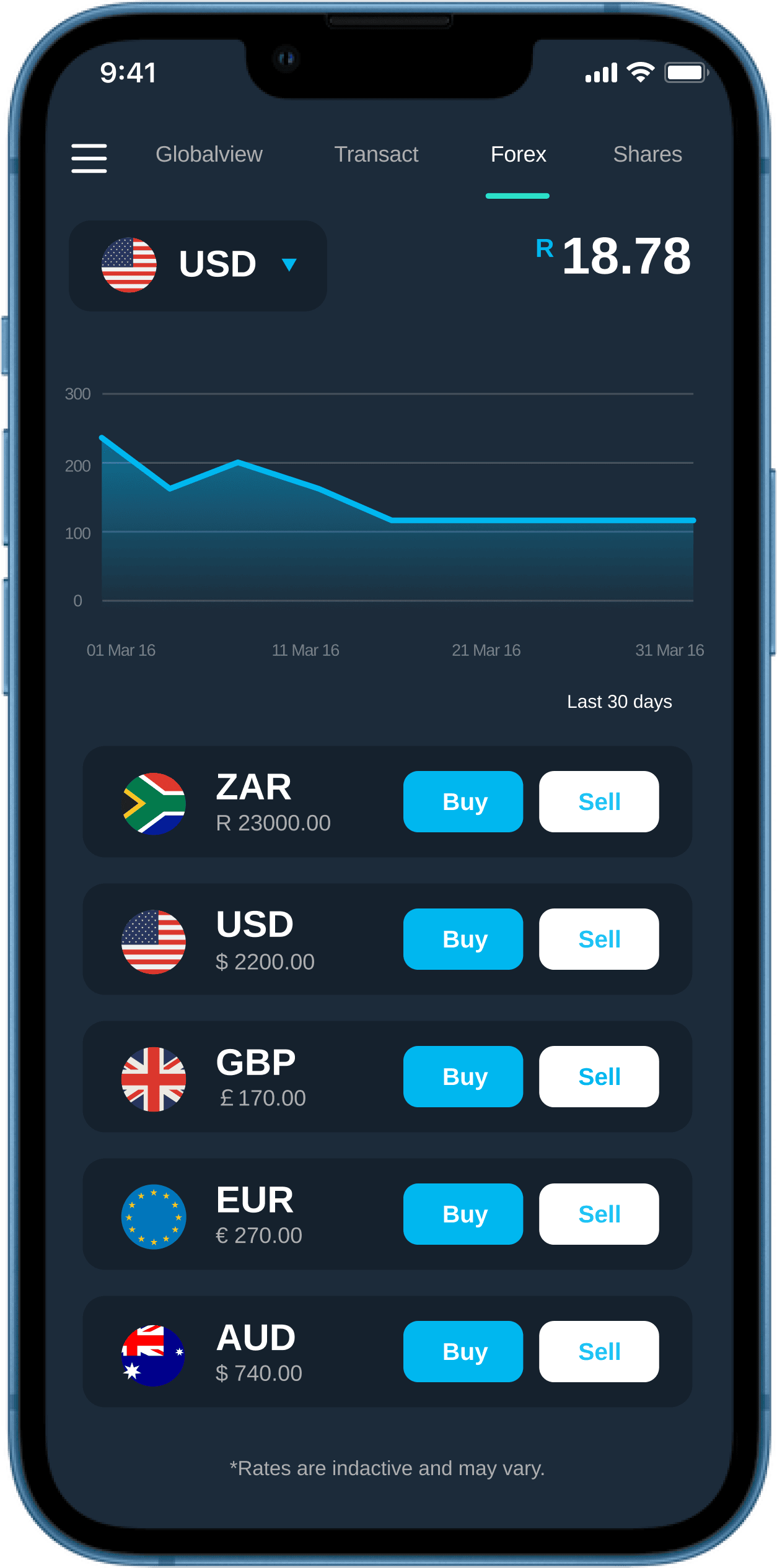

You can view your trading limit under the 'Account' section in the Shyft app.