Is South Africa’s comeback finally here? After years of slow growth, power and logistical woes, the country might finally be turning a corner. That’s the view from Standard Bank’s latest webinar, where SA Equity Strategist Deanne Gordon highlighted signs of real progress.

Gordon says the country can expect a growth lift as structural reforms work through the economy, together with lower interest rates, and also shared an outlook on SA equities.

Here are some key takeaways from that webinar (or watch the full session in the above video):

Growth forecast

Gordon says the country should see growth rise from the 1% level it has been stuck at for the last 10 years to close to 2%, if not slightly over 2%, over the next two years.

The reason?

- Structural factors: Most structural constraints that have weighed on SA’s growth, whether logistics or electricity, should start fading and moving out of the numbers over the next two to three years.

- Leadership: South Africa currently has “a good cohort of economic ministers”, particularly in the electricity, transport, and trade and industry departments, who are keen to resolve economic constraints.

- Operation Vulindlela is an initiative where government and business work together on structural reforms. “It’s absolutely critical to growth delivery in South Africa. I think it’s been very successful.”

- Inflation and interest rates: Inflation has been well-behaved and is expected to continue that way. Economists have pencilled in another 25-basis-point rate cut.

“We think that delta [pickup] in growth should drive a rerating,” Gordon adds.

SA equity market performance: what’s gone unnoticed

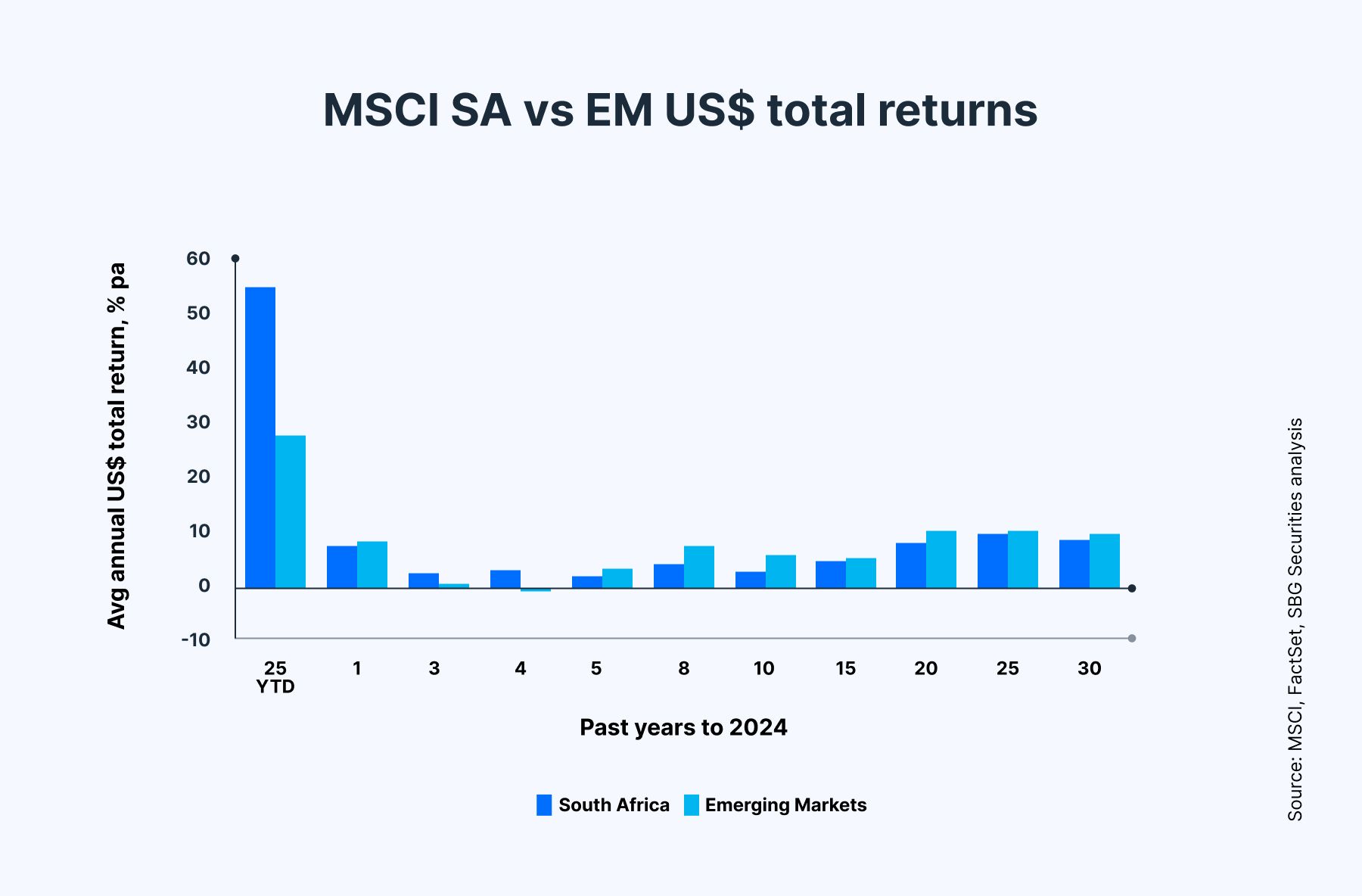

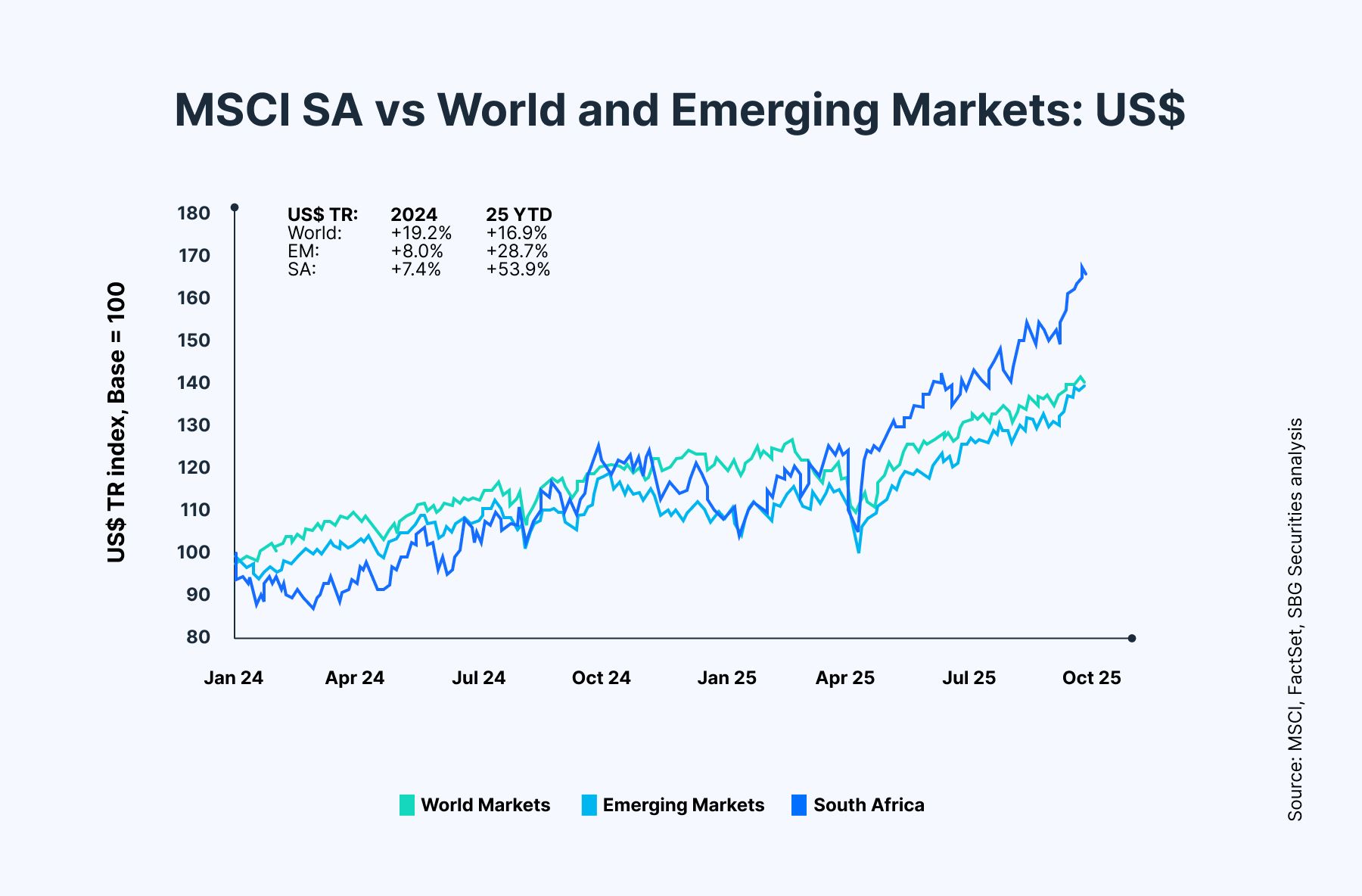

Since April 2025, the SA equity market has outperformed both emerging markets and the world, in local currency, and particularly in dollar terms.

“It’s been a very strong pattern of outperformance, largely driven by commodities and in particular gold and platinum. But we do think that the rest of the equity market is poised for a rerating catch-up trade.”

Gordon says another interesting point is that South Africa has actually outperformed emerging markets over the last four years.

“We think it’s time for SA to shine. It’s our time in the sun.”

Rand outlook

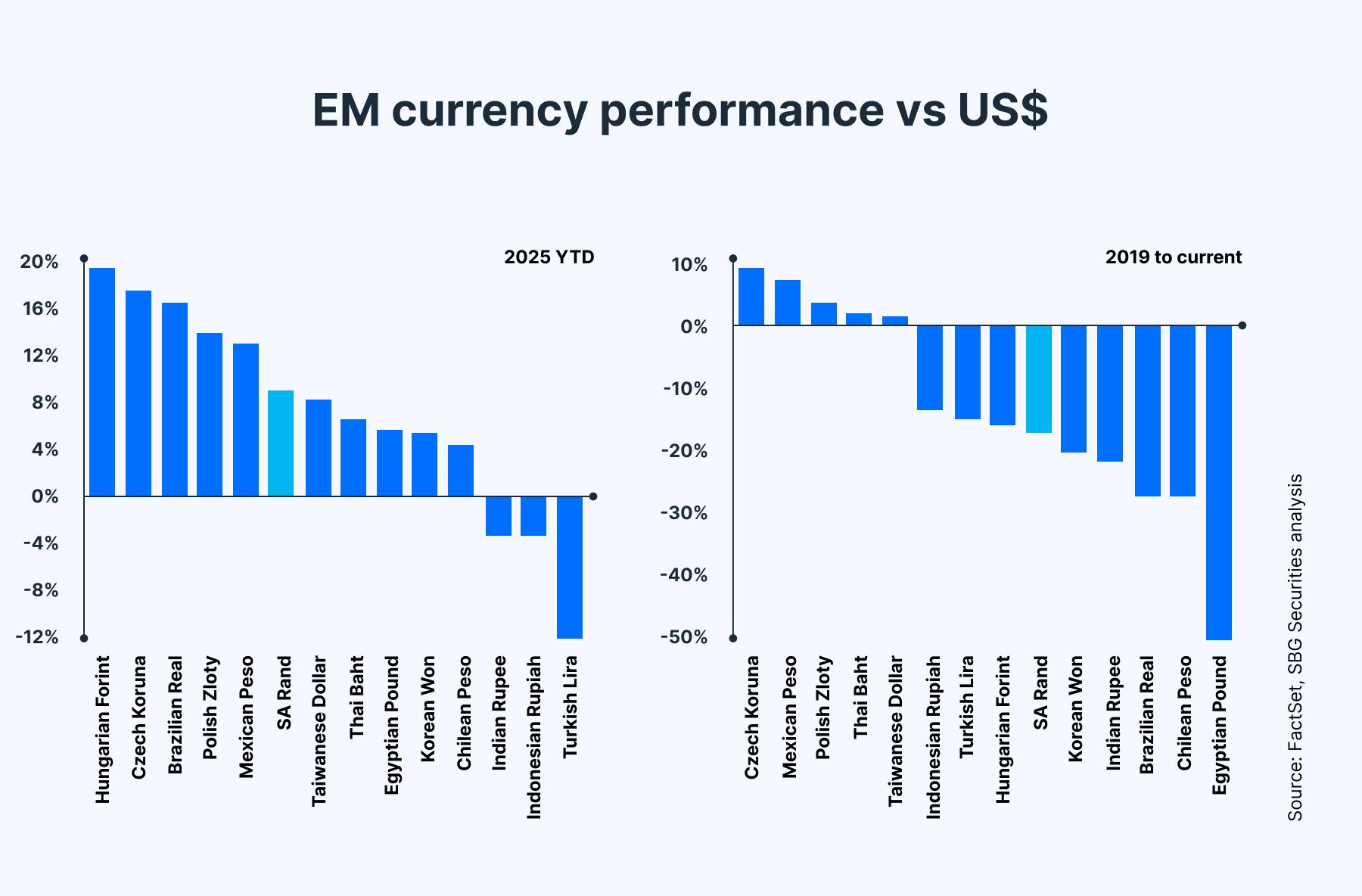

The rand and other currencies have done relatively well against the dollar.

Gordon says the rand is forecast to be “very well behaved” over the next couple of years.

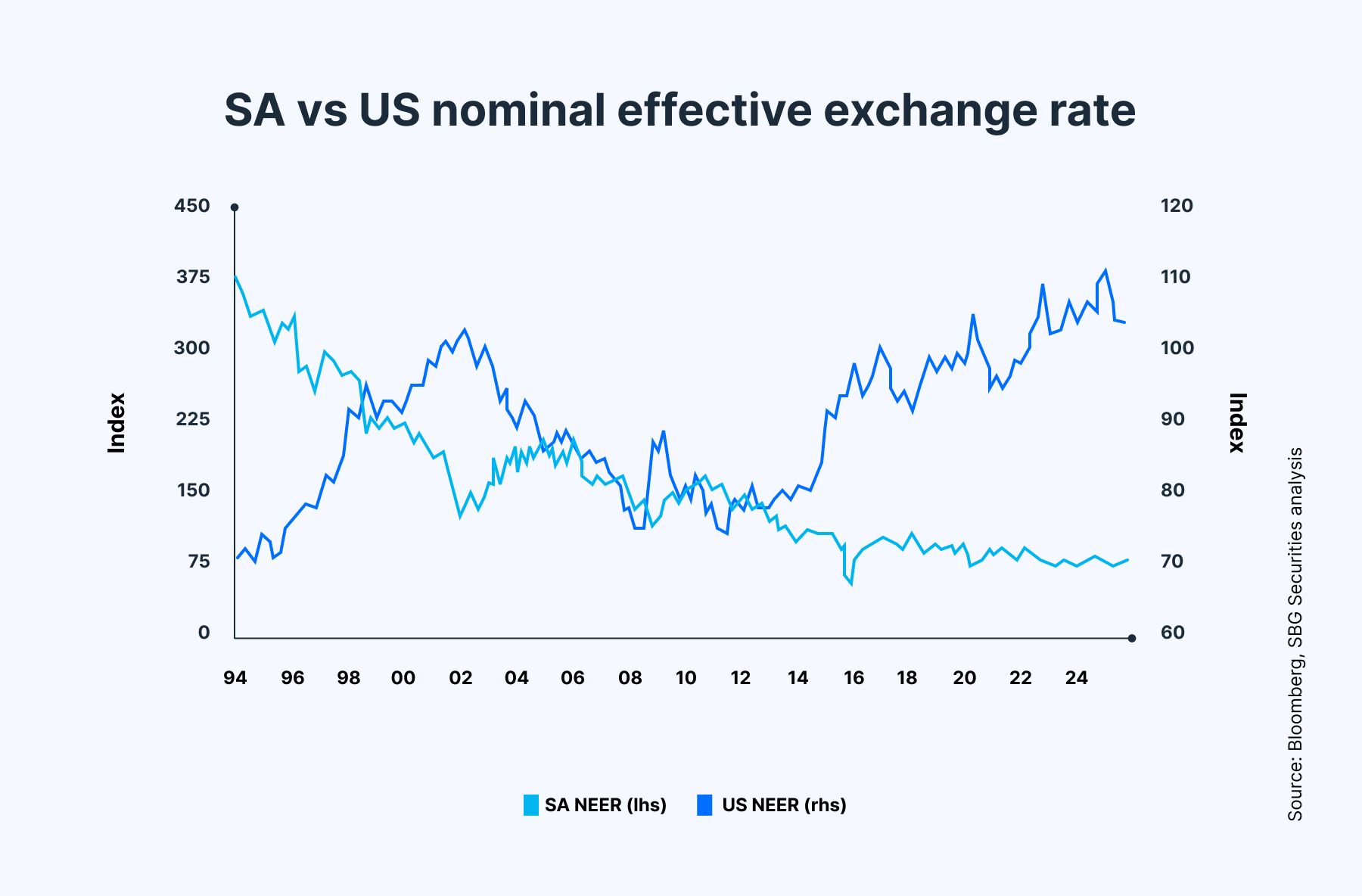

“The reason for that is a weak dollar that we think plays out over the Trump era and the dollar trend, which has been so overextended in terms of dollar strength that it’s about time that it starts pulling back somewhat. We think the rand should be a beneficiary of this trade.”

Where the rand has lagged is against the euro and the pound, “and there should be a stronger rebound across the board”.

“We think there’s much more to go in terms of the rand catch-up trade, and that on a real effective exchange rate basis, the rand is still cheap and should rerate or appreciate over the course of the next two years,” Gordon says.

What will drive the rerating catch-up trade?

In terms of both GDP and earnings growth, South Africa stands out as one of the few countries expected to show real growth momentum this year and next.

“If you look at it in absolute terms, SA should have the second-highest earnings growth numbers across emerging markets for the next two years – and it’s pretty much across the board,” Gordon says.

She adds that what’s encouraging is “we’re starting to see upward revisions in earnings, and that should also support the equity market and support a rerating trade”.

Fixed investment

Standard Bank economists’ strongest growth figures for the next two years come through from fixed investment.

“We are expecting government fixed investment to start lifting its head,” Gordon says.

Fixed investment levels versus GDP are low, so there’s huge capacity for expansion, capital expenditure replacements, and new capital expenditure projects.

“We are expecting a synchronised recovery, not just from the government finally lifting its head but also from the private sector, which is pretty much lagging.

“Private sector fixed investment as a percentage of GDP has been rather disappointing; it’s hit the lowest level ever on record.

“So, if we start seeing confidence in the Government of National Unity holding, interest rates taking hold and staying low for longer, hopefully we see a private sector cycle kicking in too,” Gordon adds.

Consumer outlook

Gordon says she’s starting to see the green shoots of a recovery from a consumption perspective, which is making her positive about the consumer.

“We are starting to see a lift in wages, which I think is largely driven by the public sector wage increase which came through recently.”

Real wages have also picked up, which usually drives a consumer spending recovery.

The ratio of employee compensation to GDP has also finally lifted, confirming that some consumer story should be playing out.

Foreign interest

SA has seen very little foreign equity inflow over the last three years.

“We are hoping that if we start seeing growth in delivery, you should start seeing foreign equity interest again.

“We definitely are starting to see renewed interest, just given that the MSCI SA commodity component is up 190% this year in dollars. So definitely renewed interest coming back in, and we think that should underpin the market as well.”

Market at a discount

Gordon says the SA market is “very, very cheap”.

“If you look at South Africa versus emerging markets, we are priced at a 20% discount. That includes Naspers and a whole host of stocks.

“And obviously against the world, we’re trading at a nearly 40% discount.”

“[The market] is pricing in no good news; we’re just pricing in bad news,” she adds.

“So, we think there is scope for a rerating trade in domestic inc., and we think SA is really well placed given the earnings growth lift that we expect.”

South Africa is also poised to see a rerating of risk assets, particularly domestic equity risk assets.

Superior dividend yields

Gordon says SA has superior dividend deals.

“Our dividend yields are trading at a multiple of nearly 1.3 times the rest of emerging markets, so compelling dividend yields across the board.”

Gold

The current gold trade is expected to continue for a while.

“While you’ve got global uncertainty and a weaker dollar playing out, it’s definitely looking like this trade could last a bit longer,” Gordon says.

Something to watch is gold production, which has been in decline since the 70s.

“But what we’ve seen in the last couple of quarters is some increase in production, and our gold analyst expects a bit of new projects to come on stream, which could potentially impact that.”

If you want to tap into SA’s growth story, you can invest in local shares and ETFs on Shyft. Remember to consult a financial advisor before making investment decisions.

The views and opinions shared are for informational purposes only. They are not intended to serve as investment advice and do not represent the views or opinions of Standard Bank. This information should be used as a starting point for generating investment ideas, and should not be relied upon as the basis for making investment decisions. The Standard Bank of South Africa Limited will not be responsible for the results of any investment decisions made based on the views provided.